Performance Is No Longer Protection

How AI, Wall Street, and layoffs rewired the rules of career safety

High performers across every industry are learning the same lesson at the same time: the rules they built their careers on quietly changed.

For decades, ambitious operators worked under an implicit understanding: performance bought protection. Strong ratings, critical initiatives, and exceeding expectations were the currency that purchased job security. Layoffs happened to underperformers, to other functions, and to companies that made bad bets.

That logic no longer holds.

In 2025 alone, U.S. employers have announced more than 1.1 million job cuts,1 the highest level since the pandemic shock of 2020. Tech, finance, retail, and professional services are all shedding roles at once. What’s different this time is not just the scale. It’s who is being cut.

Increasingly, it’s high performers in the middle and upper tiers of organizations.

Over the past fifteen years leading supply chain and operations teams across Fortune 500 companies, I’ve seen where headcount decisions actually get made. I’ve watched the language shift from discussing labor as a talent strategy to discussing it as a balance-sheet variable. When labor becomes a balance-sheet variable, it stops being treated as a long-term asset and starts being managed like any other cost that can be raised or cut to protect short-term financial performance. This is why so many people who did everything “right” are now learning an uncomfortable truth: performance is no longer protection.

This is Career Fragility, the structural exposure that high performers now face when companies treat employees as options rather than assets.

Career Fragility: The Psychological Contract That Broke

For decades, the psychological contract between knowledge workers and firms was built on a stable exchange. You provided consistency and upward-sloping performance, and in return, companies provided relative predictable progression and insulation from shocks. That model made sense in a world where capital was expensive, coordination was slow, technology scaled linearly, and growth was constrained by human throughput. Millions of careers were built on this quiet logic. What ended this contract was not a shift in corporate ethics but a full repricing of the economics underneath it.

From Assets to Options: The Mental Model Shift

Companies used to treat experienced employees as long-duration assets, valuable investments to protect, develop, and retain. The switching costs were high, the knowledge was sticky, and the planning horizons were long enough to justify patience. They now increasingly treat them as options. An option is not something you commit to protect indefinitely. It is something you hold because it gives you flexibility under uncertainty. It is valuable precisely because you can exercise it—or let it expire—depending on how conditions evolve.

When AI compresses the cost of cognitive output, when economic cycles trigger faster resets, and when capital markets reward headcount discipline, the calculus changes. AI compresses the cost of cognitive output by making thinking-based work faster, cheaper, and less dependent on large teams. The old assumption, that investing in your people always pays off over time, now competes with a new assumption: that flexibility itself is the asset worth protecting.

The implications are profound. Under the asset model, the rational move was to retain strong performers through downturns because the cost of rebuilding institutional knowledge exceeded the cost of carrying them. Under the option model, the question becomes: does keeping this role open future possibilities, or does it constrain them? That’s a much more volatile calculation. And it can flip against you even when you’re performing well.

Three Forces Made This Inevitable

AI is collapsing the cost of white-collar output. Research from the Brookings Institution2 finds that more than 30% of U.S. workers could see at least half of their occupational tasks disrupted by generative AI, including high-skill cognitive roles long considered “safe.” The baseline of what one operator plus tools can produce is rising structurally. For firms, this shifts the headcount calculus. Fewer people may now be required to achieve the same output.

Economic slowdowns now trigger faster, harder resets. When economic pressure arrives, firms are no longer relying on hiring freezes or bonus compression. They are executing headcount resets. Through October 2025, announced U.S. job cuts exceeded 1.099 million3, the highest level for that period since 2020. The severity and speed matter deeply for anyone relying on loyalty or track record as insulation.

Capital markets now hardwire labor as a margin lever. On earnings calls, labor is increasingly discussed alongside cloud spend, real-estate commitments, and SG&A normalization. In both public markets and private-equity-backed firms, workforce reductions are framed as margin-defense measures, not long-term capability investments.

When these three forces combine, the old link between performance and protection breaks mechanically.

This Is Not Your Failure

If you are reading this with a knot in your stomach, that response is entirely reasonable. Many professionals, especially those early in their careers, have built their futures on the belief that sustained excellence would produce long-term stability. For much of the past century, this implicit promise guided earlier generations as they made decisions about family life, home ownership, and retirement planning.

Although frustration is an understandable initial response, remaining anchored in it won’t lead to a constructive outcome. People who fare well in periods of structural change tend to be those who recognize the shift early and adjust their strategy. A willingness to adapt matters more now than holding on to an older idea of what’s fair, and it gives you a much better chance not only to navigate the changes ahead but also to turn them into real opportunities.

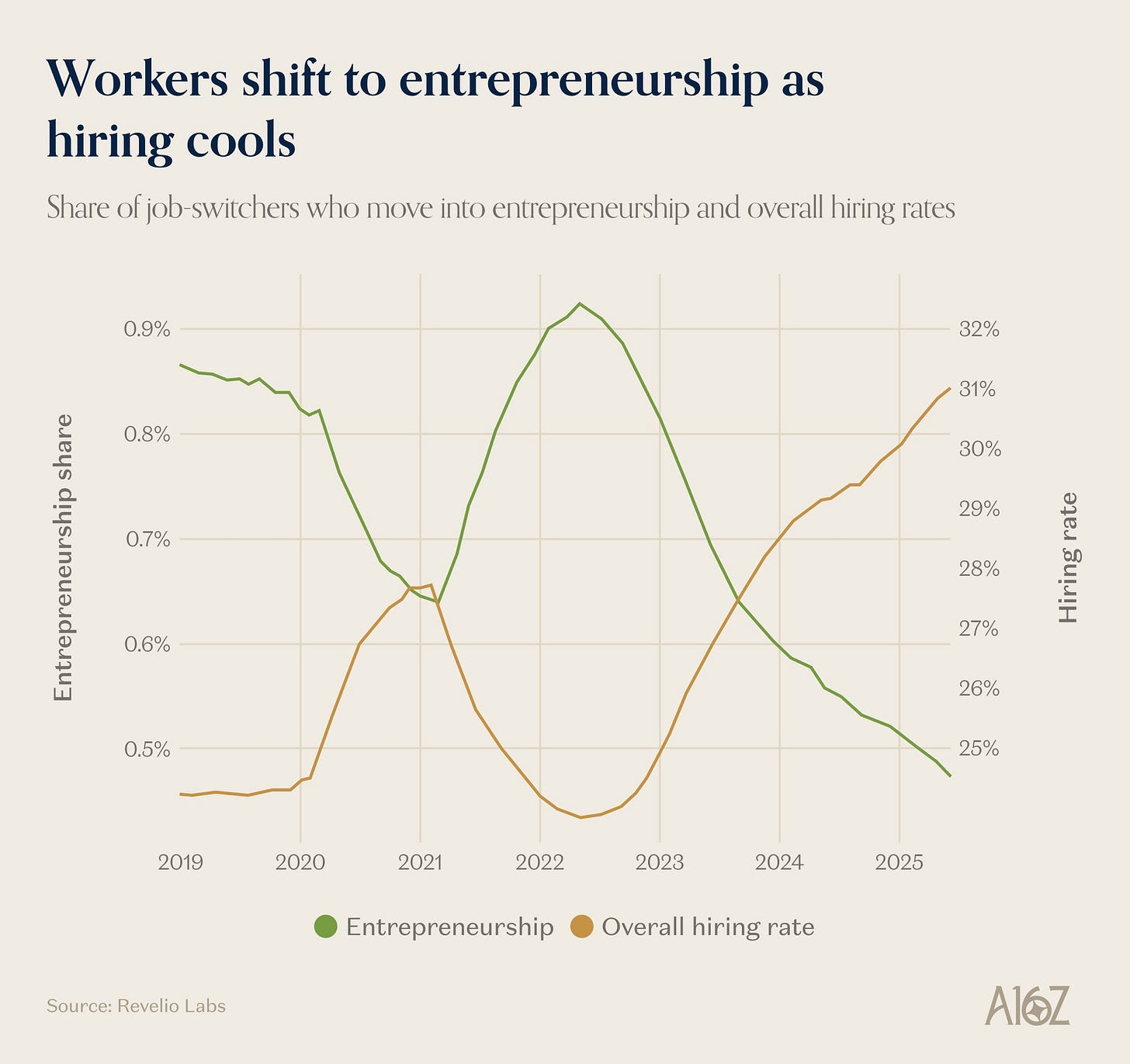

Entrepreneurship Is the Behavioral Response, Not a Cultural Trend

As institutional career sponsorship weakens, people respond rationally.

For the first time in decades, millions of workers are being pushed, not pulled, into independent and portfolio-style work. This is why, as hiring cools, rates of entrepreneurship rise. Not because millions of workers suddenly discovered a passion for founder life, but because the firm is no longer a reliable risk absorber of personal career risk.

This is not a creator boom. It is a balance-sheet shift.

When institutions stop underwriting careers, individuals are forced to self-insure. Founders need customers. Independents need distribution. Fractional leaders need deal flow. Advisors need both trust and visibility.

All of that is network-first economics. In a network-first economy, access to opportunity flows through relationships and trust before it flows through formal job structures.

What we are watching is the early formation of a parallel labor market that runs alongside traditional employment rather than beneath it.

What This Means for You

Single-employer careers are quietly becoming single-point-of-failure careers. When all of your reputation, relationships, and work product live inside one organization’s systems, you are structurally easy to erase.

This is why network optionality now protects careers in a way performance alone no longer can.

Loyalty has become asymmetric. Employees are still expected to commit fully, even as firms no longer reciprocate with long-horizon security. Promotions are increasingly defensive rather than developmental. And personal risk has moved down the org chart. Volatility that used to be absorbed by capital now sits with individuals and families.

What we’re describing has a name: Career Fragility. It’s not a personal failure. It’s a structural condition. And it requires a structural response.

The New Rules

If performance now functions as a qualifier rather than a shield, four things matter more than ever.

Build in public inside your domain.

Private excellence that never leaves your organization has shrinking economic protection.

Become useful outside your org chart.

If all your value exists inside one company’s systems, it is easy to erase.Convert relationships into shared work.

Projects, advisory roles, writing, teaching, and operating collaborations create compounding network equity.Anchor your reputation in judgment, not output.

Output is increasingly automatable. Judgment is not.

Networking used to accelerate careers. It now also stabilizes them.

A Warning for the New Year

The most exposed professionals in the next decade will not be the lowest performers. They will be the most loyal single-employer optimizers in a world that no longer sponsors single-employer safety.

Your role belongs to your company and your paycheck still comes from your company, but your future is being shaped elsewhere, whether you are participating in that reality or not.

Your First Move in January

I’ll write soon about what ‘building your network’ actually means in an era of Career Fragility and the difference between visibility that looks good and embedded relationships that actually protect you.

But if you take one thing from this piece, take one action this month: help one peer at another company, advise one small team, join one working group. Do it before urgency forces your hand.

The entire point is to be embedded in opportunity before you need it.

Rooting for you,

Justin

Motivated to develop your career? Subscribe to Career Field Guide for insider stories and frameworks to help you build resilience into your career.